I was searching Linkedin last evening and read a comment from somebody about how “Black Friday sales have been down the last few years.”

I was searching Linkedin last evening and read a comment from somebody about how “Black Friday sales have been down the last few years.”

The comment came with no facts to back the assertion, and it fit neatly into the “e-commerce is causing a retail apocalypse” narrative that we’re seeing and will see when the weekend sales are written up on Monday morning. I thought the comment might have been lazy acceptance of a story, so I thought it was time to do my own research.

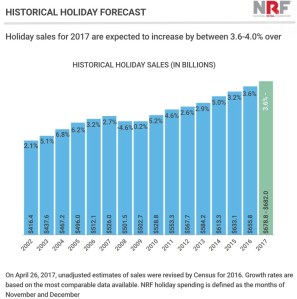

First, retail holiday season retail sales are continuing to increase, per the NRF with their forecast for this year pegged at a gain of 3.6 to 4% as compared to last year. OK, maybe the NRF has an agenda, as they are an association of retailers who generally stand to lose if online sales continue to grow.

If you’re going to grow the quarterly sales, you’re going to do it on Black Friday, when a substantial fraction of all Q4 sales are made.

I figured that online sales were probably growing a lot more quickly than offline sales, if my own household’s expenditures are any indication. (Of course, that’s n=1, always a red flag.)

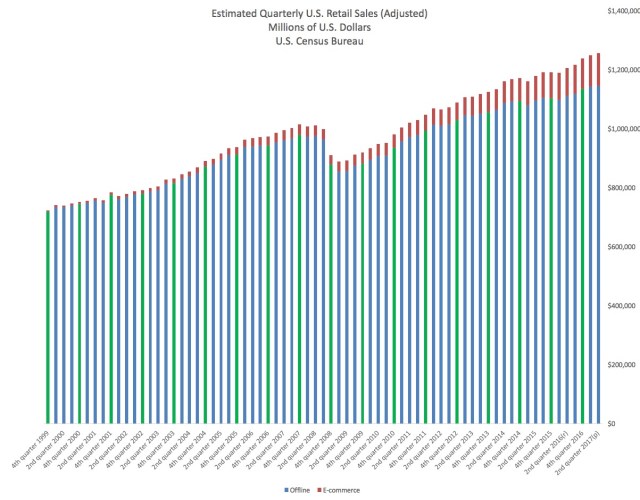

So I took a look at the data from the U.S. Census bureau, which tracks seasonally adjusted retail sales, and splits up those sales between e-commerce and traditional retail. Do they have the breakdown perfect? No, but it’s probably directionally correct. Here’s what the quarterly data looks like. I’ve highlighted the traditional retail Q4 sales in green.

You’ll notice that that the size of the red bar–the online sales–is indeed increasing rapidly, particularly in the last few years. Going back to Q4 2011, here’s maximum, minimum and average QoQ growth rates:

- All retail: Max 2.4%, Min (1.0%), Average .9%

- Offline: Max 2.3%, Min (1.3%), Average .7%

- E-commerce: Max 6.0%, Min 1.7%, Average 3.5%

Over the same period (going back to Q4 2011), the YoY changes for ecommerce have averaged 14.7% and been as much as 17.6% (Q4 2011 vs Q4 2010). There is no question that ecommerce sales (Amazon) will continue to grow dramatically, aided by Amazon’s increasing ability to cross-subsidize from the AWS business and the advantages of not needing to collect tax in many municipalities.

But there’s something about rapid growth from a small (zero) base. Here’s how much of your retail dollar is spent online for the holiday quarter, going back to 2011:

- Q4 2016: $0.08

- Q4 2015: $0.07

- Q4 2014: $0.07

- Q4 2013: $0.06

- Q4 2012: $0.06

- Q4 2011: $0.05

Different than the “sky is falling” narrative, isn’t it? My guess is that the share of holiday spending spent online this year as compared to last year will increase once again by 14-15% as it has the last several years. But that still means that >90% of everything sold in the U.S. will come out of a brick and mortar store in Q4 2017.

Black Friday isn’t dying, even if it’s becoming less important. Retail isn’t dead, even if the narrative says so. And customers still like to touch a lot of what they buy, before they buy it, even if that doesn’t fit the tech narrative.

Takeaway: When you see easy stories, question them. Do primary research. Run your own numbers. Draw your own conclusions. And win.

Next week, as you’re doing your annual IT work for parents, in-laws, aunts and uncles, take a few minutes and talk about protecting privacy and improving their cybersecurity.

Next week, as you’re doing your annual IT work for parents, in-laws, aunts and uncles, take a few minutes and talk about protecting privacy and improving their cybersecurity. Bravo to Group M for

Bravo to Group M for  Now that ads.txt is getting traction, with

Now that ads.txt is getting traction, with  This

This  Out of nowhere, something appears on your radar. You’re not sure how long it’s been there.

Out of nowhere, something appears on your radar. You’re not sure how long it’s been there. I had an interesting discussion on continuity acquisition strategy yesterday, which boiled down to two questions:

I had an interesting discussion on continuity acquisition strategy yesterday, which boiled down to two questions:

You must be logged in to post a comment.